Iron ore has once again sparked a "crazy stone" phenomenon. Since the second half of 2012, prices have dropped below $90 per ton, hitting a three-year low, but they have since rebounded to around $123.51 per ton and are still climbing. In just three months, the price has surged by 50%, reigniting speculation about a potential bubble. The recent announcement of a 4 trillion yuan urbanization investment plan has further fueled this upward trend. However, despite the sharp rise, many industry experts remain skeptical, arguing that the current surge is unsustainable.

CRU recently predicted that iron ore prices will peak next year before declining. They noted that increased production from major miners in Australia and Brazil will offset temporary supply shortages caused by India's export restrictions. As a result, global iron ore supply is expected to grow in the fourth quarter and into the following year. Meanwhile, China’s GDP growth and global steel output are slowing down, which could lead to a decline in iron ore prices after their peak. CRU estimates that the price may reach a high of $128 per ton in 2013, suggesting that significant further increases are unlikely, and downside risks are on the horizon.

Foreign miners remain optimistic about China’s demand, driven by strong downstream steel market activity. Given China’s heavy reliance on iron ore imports, this confidence has led to a sharp price increase. However, even with predictions of improved steel demand next year, the actual bottom for traders and merchants might not be as promising. If the demand from downstream sectors doesn’t meet expectations, the market could face challenges.

Urbanization has become a hot topic in China, with a projected 4 trillion yuan investment over the next decade. But the real question is: where will the funding come from? Urbanization requires massive capital for infrastructure and migrant worker integration, yet local governments are struggling with reduced fiscal revenues and debt constraints. This raises doubts about how effectively urbanization can be implemented in the coming years.

Additionally, the Ministry of Housing and Urban-Rural Development announced that it will continue to enforce strict housing policies in 2013, including credit controls and purchase restrictions, to curb speculative demand. The government also plans to complete 4.6 million affordable housing units and build 6 million new ones, slightly less than the 7 million started in 2012. This suggests that demand for steel from housing projects may weaken in 2013.

The downstream industries of the steel sector, such as shipbuilding, remain sluggish. Shipbuilding completed 50.55 million DWT through November, a 18.2% drop compared to the previous year. New orders fell by 49.4%, and the backlog of orders decreased by 30.3%. These figures indicate that the shipbuilding industry is facing a deep downturn, which may last longer than expected. Similarly, the appliance and automotive industries are dealing with large inventory levels.

Overall, steel demand next year remains uncertain. Construction in the north is unlikely to resume soon, and demand in the south is also declining. The rapid rise in iron ore prices may not be sustainable. Over the past two years, China’s iron ore import sources have expanded from 28 to 67 countries, increasing its bargaining power. The tightest supply phase has passed, and future ore price trends will likely follow those of steel prices.

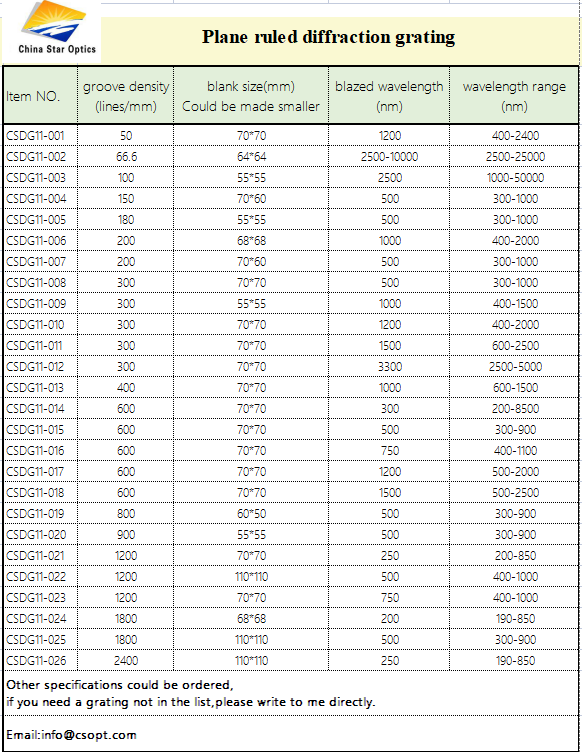

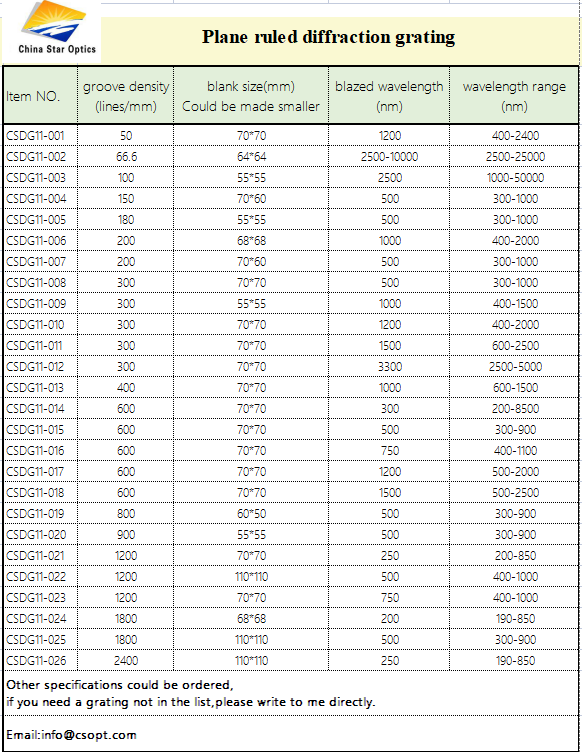

Plane Ruled Grating

Plane ruled gratings are characterized by a superior efficiency at their design wavelength compared with holographic gratings. Plane Ruled gratings comprise the majority of diffraction gratings used in spectroscopic instrumentation and are especially useful in systems requiring high resolution.Â

China star optics can provide customers with a variety of replicated grating products such as diffraction gratings, reflective gratings,holographic gratings,concave gratings etc. to meet different needs. Maximum ruled area is up to 300 x 300 mm for plane ruled diffraction gratings. For replicated diffraction and transmission gratings the ruling density can be from 20 grooves per millimeter to 2400 grooves per millimeter, wavelength from 0.2 micron to 25 microns.Â

Holographic gratings:

Specifications:

Ruled area: <=70 * 70mmÂ

Wavelength range: 0.2-0.8umÂ

Grooves per mm: 1,200 to 3,600L/mm

Diffraction: >70%Â

Ruled gratings:

Specifications:

Ruled area: <=70 * 70mmÂ

Wavelength range: 0.2-15umÂ

Grooves per mm: 50 to 2,400L/mmÂ

Diffraction: >70%

Concave gratings:

Specifications:

Ruled area: <=70 * 70mmÂ

Wavelength range: 200 to 900umÂ

Grooves per mm: 490 to 1,200L/mmÂ

Diffraction: >70%

Plane Ruled Grating,Plane Ruled Diffraction Grating,Plane Reflection Grating,Plane Ruled Reflective Grating

China Star Optics Technology Co.,Ltd. , https://www.csoptlens.com